Whether you are a college student, a corporate employee, or a government servant, we all want to save money and start building our finances for our better future. But where to start? With the financial ecosystem so diverse, it is very easy to get confused. Do you invest in stock? Or crypto? Do you spend your money on mutual funds? All these questions can cloud your brain.

But with new technology, a new player has entered the arena of savings: the ETFs. So, what are ETFs, and which is better, mutual funds or ETFs? We will take a look at all these questions in our comparison of ETF vs Mutual Funds.

Table of Contents

ETF vs Mutual Funds: What Are They?

Let’s first try to understand what these two are. It is important to understand the concepts behind these two and how they work before you choose one as your savings option.

So, let’s dive into the main comparison of ETF vs Mutual Funds.

1. Mutual Funds:

Mutual funds are investment vehicles that take money from many investors and invest it in a diverse portfolio of securities like stocks, bonds, and other assets. Think of mutual funds as an investment club where everyone contributes money.

Here’s how mutual funds work:

- Pooling Money: You and other investors like you give your money to a mutual fund company.

- Professional Management: Once the company pools the money, it hands it to a team of professional fund managers who buy and sell securities on your behalf. These managers aim to meet the fund’s specific objective, i.e., income, growth, and stability.

- Diversification: Diversification is a fancy word for not putting all the apples in the same basket. The fund is invested in diverse securities, instead of investing all the money in the same stock or asset. Why? To reduce the risk. If one company performs poorly, it won’t hurt the entire portfolio.

- Pricing: Unlike stocks, which trade throughout the day, a mutual fund’s price (called the Net Asset Value or NAV) is calculated only once per day after the market closes.

Now that we know what Mutual funds are. Let’s move on to ETFs and how they work.

2. ETF:

ETF is short for Exchange-Traded Fund. Think of it like a basket of securities, very similar to mutual funds. They also pool money from investors to buy a variety of assets such as stocks, bonds, or commodities. But there is a key difference: unlike mutual funds, these are exchange-traded.

So what does exchange-traded mean? Let’s try to understand that:

- Trading Like a Stock: Unlike mutual funds, an ETF is bought and sold on the stock market throughout the day. This gives you the flexibility to trade at the current market price at any time the market is open, just like you would with a single stock.

- Passive Management: Most ETFs are passively managed. What does that mean? Well, ETFs are designed to track specific market indices, like the S&P 500 and NASDAQ 100, rather than beating them. The fund manager’s job is to make sure the ETF matches the index.

- Low Cost: As they are less actively managed, ETFs generally have lower fees compared to mutual funds.

- Accessibility: You can buy a single share of an ETF, which often costs less than the minimum initial investment required by many mutual funds. This makes them highly accessible for new investors with limited capital.

ETF vs Mutual Funds: Key Differences and Features

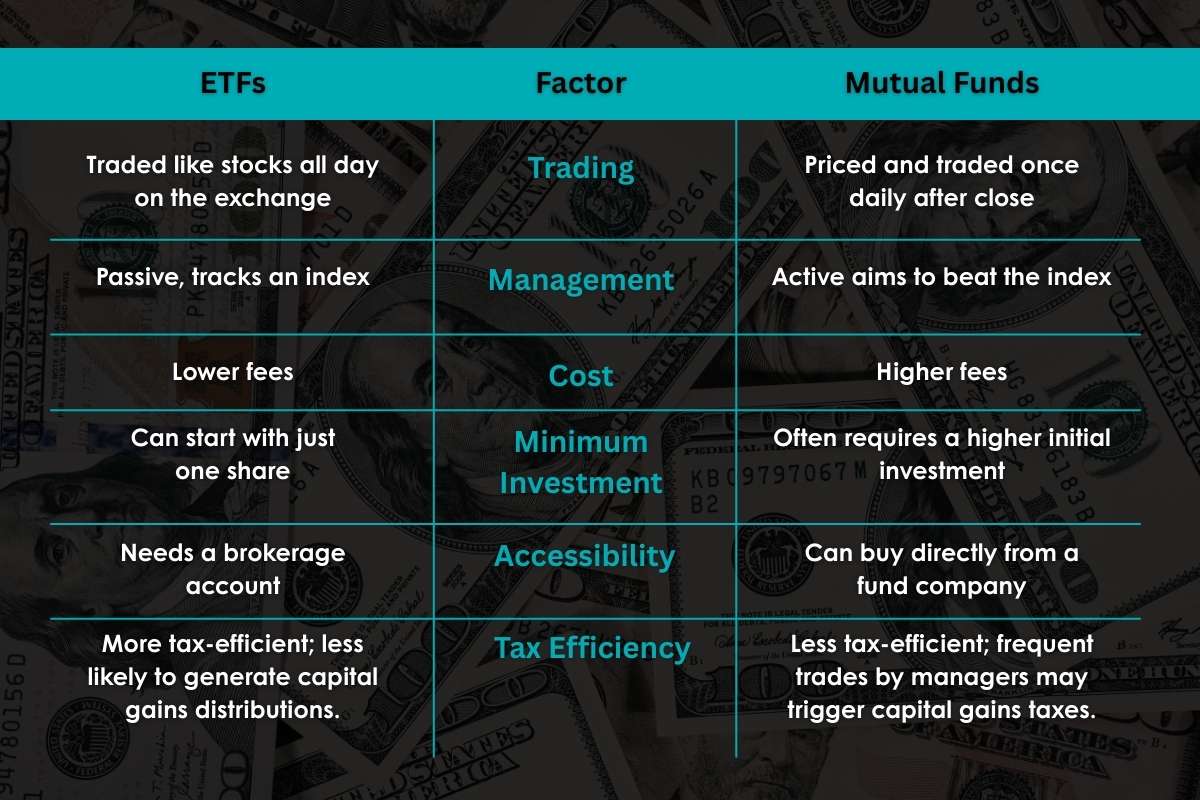

Six main features differentiate ETF vs Mutual Funds, i.e., trading, management, costs, minimum investment, accessibility, and tax efficiency.

In this section, we will take a closer look at these features and how they are different for the security options.

| Factor | ETFs | Mutual Funds |

|---|---|---|

| Trading | Traded like stocks all day on the exchange | Priced and traded once daily after close |

| Management | Passive, tracks an index | Active aims to beat the index |

| Cost | Lower fees | Higher fees |

| Minimum Investment | Can start with just one share | Often requires a higher initial investment |

| Accessibility | Needs a brokerage account | Can buy directly from a fund company |

| Tax Efficiency | More tax-efficient; less likely to generate capital gains distributions. | Less tax-efficient; frequent trades by managers may trigger capital gains taxes. |

1. Trading:

The main difference between ETF vs mutual funds is how they are traded. ETFs are bought and sold like stock on an exchange throughout the day. You can trade it at any time of the day during market hours.

Whereas mutual funds are traded only once after the market closes. All orders are executed at the same daily price.

2. Management:

ETFs are passively managed. It’s designed to track a particular index. The goal of an ETF is to match the market index, not beat it.

But mutual funds are quite the opposite of it. The fund manager actively chooses and picks securities that outperform the market index.

3. Cost:

ETFs generally have lower fees (expense ratios) because they are passively managed and less hands-on.

But mutual funds have higher fees because you are paying for the expertise of the professional fund manager.

4. Minimum Investment:

If you invest in an ETF, you can buy a single share to start. It makes this investment a lot more accessible to small investors and beginners.

Mutual funds, generally, require a higher amount in initial investment in comparison to ETFs. They sometimes might cost hundreds or thousands of dollars to start a mutual fund.

5. Accessibility:

If you want to buy an ETF, you will need a brokerage account to buy and sell stocks. But if you want to buy mutual funds, you can directly contact a fund management company and buy one without an account.

6. Tax Efficiency:

ETFs are more tax-efficient because of the way they are traded. Since they trade on an exchange, they are less likely to generate capital gains distributions for existing shareholders.

Whereas mutual funds are less tax-efficient than ETFs due to the fund manager’s frequent buying and selling of securities within the fund, which can trigger capital gains distributions for all shareholders.

So, now that you know these differences, which one do you choose? ETF vs mutual fund, which is better? Still unsure? Let me help you by explaining the top ETFs and Mutual funds and the benefits of choosing either of the investment options.

Also Read: Unlocking Financial Literacy: The Imperative of Finance Education

Top ETFs You Can Invest In

Here’s a list of three ETFs that have the best returns in the market.

1. Vanguard FTSE All-World UCITS ETF:

If you are looking for a simple, single-fund solution for exposure to global equity, this is the ETF for you. The Vanguard FTSE All-World UCITS ETF (VWRL) is designed to give investors global exposure through a single fund. It currently holds shares in more than 3,600 companies across over 50 countries.

- Expense Ratio: 0.22%

- P/E Ratio: 21.9% (as of July 31, 2025)

2. iShares Core MSCI EAFE ETF:

iShares (IEFA) is a low-cost ETF designed to give broad exposure to large, mid, and small-cap stocks in the developed market outside the US and Canada. It tracks the MSCI EAFE IMI Index, which covers over 2,600 equities across Europe, Australasia, and the Far East.

- Expense Ratio: 0.07%

- P/E Ratio: 17.41% (as of July 31, 2025)

3. Invesco S&P International Developed Quality ETF:

Invesco S&P International Developed Quality ETF (IDHQ) focuses on high-quality large and mid-cap stocks from developed markets outside the US. It tracks the S&P Quality Developed ex-U.S. Large-MidCap Index, which selects stocks with the highest quality scores based on fundamental measures.

The quality is measured on three factors, i.e., return on equity, accruals ratio, and financial leverage ratio.

- Expense Ratio: 0.07%

- P/E Ratio: 17.66% (as of June 30, 2025)

Who to Choose: ETF vs Mutual Funds

Let’s take a look at why ETF is a good option first, shall we?

Why Choose an ETF?

- Transparency: Most ETFs are fully transparent, meaning their holdings are disclosed daily. This allows you to know exactly which stocks and bonds you own at all times, giving you more control and visibility into your investments.

- Liquidity: Because ETFs trade on an exchange, they are highly liquid. This means you can easily buy and sell shares with little difficulty. For most investors, this isn’t a huge concern, but for those who might need to access their funds quickly, it’s a significant advantage.

- Targeted Investments: The ETF market has expanded to offer very specific, niche investment opportunities. You can find ETFs that focus on a particular sector (like technology or clean energy), a specific country, or a certain investment strategy, giving you a very precise way to invest in a specific trend or theme.

Sounds tempting? But don’t make the decision yet. There’s more!

Now, we will take a look at the benefits of mutual funds.

Top Mutual Funds You Can Invest In

Now, let’s talk about three mutual fund options you can choose from.

1. Edelweiss US Technology Equity Fund of Fund (FoF)

Edelweiss US Technology Equity Fund of Fund (FoF) is an open-ended mutual fund scheme that primarily invests in JP Morgan-US Technology. The fund targets long-term capital growth in the US market.

- Risk Profile: Very High

- Expense Ratio: 1.6%

2. Franklin U.S. Opportunities Equity Active Fund of Funds (FoF)

Franklin U.S. Opportunities Equity Active Fund of Funds (FoF) is another open-ended mutual fund. It invests mostly in the US across various sectors, including technology, healthcare, consumer discretionary, and financial sectors.

- Risk Profile: Very High

- Expense Ratio: 1.53%

- Reference: https://investors.franklinresources.com/investor-relations/financial-information/default.aspx#section=sec

3. Waverton European Dividend Growth Fund

If you want to invest your money in European stocks, the Waverton European Dividend Growth Fund is your top option. The fund focuses on Europe beside the UK. It invests in around 38 holdings, focused on wealth-creating companies at attractive valuations with strong management.

- Risk Profile: Moderate

- Expense Ratio: 0.86%

Why Choose Mutual Funds?

- Automated Investing: Mutual funds make it incredibly easy to automate your investments through systematic investment plans (SIPs). This feature allows you to regularly contribute a fixed amount of money, which builds a disciplined saving habit and takes the emotion out of investing.

- No Commissions: While ETFs have low expense ratios, you often have to pay a commission to a brokerage to buy or sell them. In contrast, many mutual funds are “no-load,” meaning you don’t pay a sales commission when you buy or sell shares. This can be a cost-saver if you plan on making frequent, small investments.

- Convenience for Beginners: Mutual funds simplify the investment process. They are a great “set it and forget it” option for beginners who don’t want to worry about intraday pricing or managing a brokerage account, as you can often buy them directly from the fund company.

Conclusion:

Choosing between an ETF and a mutual fund ultimately comes down to your personal investing style and financial goals. ETFs offer flexibility, lower costs, and tax efficiency, making them great for investors who want to actively trade or invest with minimal fees. On the other hand, mutual funds provide a hands-off, beginner-friendly experience with the advantage of professional management and easy, automated investing through SIPs.

For the college student just starting out, both options offer a fantastic way to begin building wealth through diversification. The most important step is simply to start. By understanding the core distinctions in this ETF vs Mutual Funds comparison, you can make an informed choice that aligns with your financial journey.

Remember, the best investment is the one you understand and feel comfortable with. It doesn’t matter what you pick between ETF vs mutual funds, you’re taking a smart step toward securing your financial future.

FAQs

1. Can I invest in both, or do I have to choose just one?

Yes, you can and should invest in both. They serve different purposes and can complement each other in your portfolio. They are not rivals, even if we see them as ETF vs Mutual funds, but rather tools you can use together to achieve your financial goals.

2. Are ETFs always better because they have lower fees?

No, lower fees are not the only factor. Some investors prefer mutual funds for the peace of mind that comes with professional management and a hands-off approach.

3. Can I lose money with ETFs or mutual funds?

Yes, both investments carry the risk of losing money, as their value fluctuates with the broader market.