Adobe Inc. (NASDAQ: ADBE) is confronting renewed competitive pressures as Canva, a privately held design platform, accelerates its expansion. In a bold move, Canva has acquired MagicBrief, an AI Innovation ad technology company that specializes in helping marketers understand and respond to high-performing content strategies for Adobe Firefly. Although the financial details of the acquisition remain officially undisclosed, reports from Citizens JMP suggest Canva paid approximately $10 million for the startup.

MagicBrief had previously raised $1.3 million in a pre-seed funding round in July 2023, led by Blackbird Ventures, signaling early investor confidence in its potential. Canva’s latest acquisition underscores its intent to enhance its AI capabilities and stake a larger claim in the digital content and advertising landscape—an arena long dominated by Adobe. This move places Canva in a stronger position to rival Adobe in the competitive creative software market.

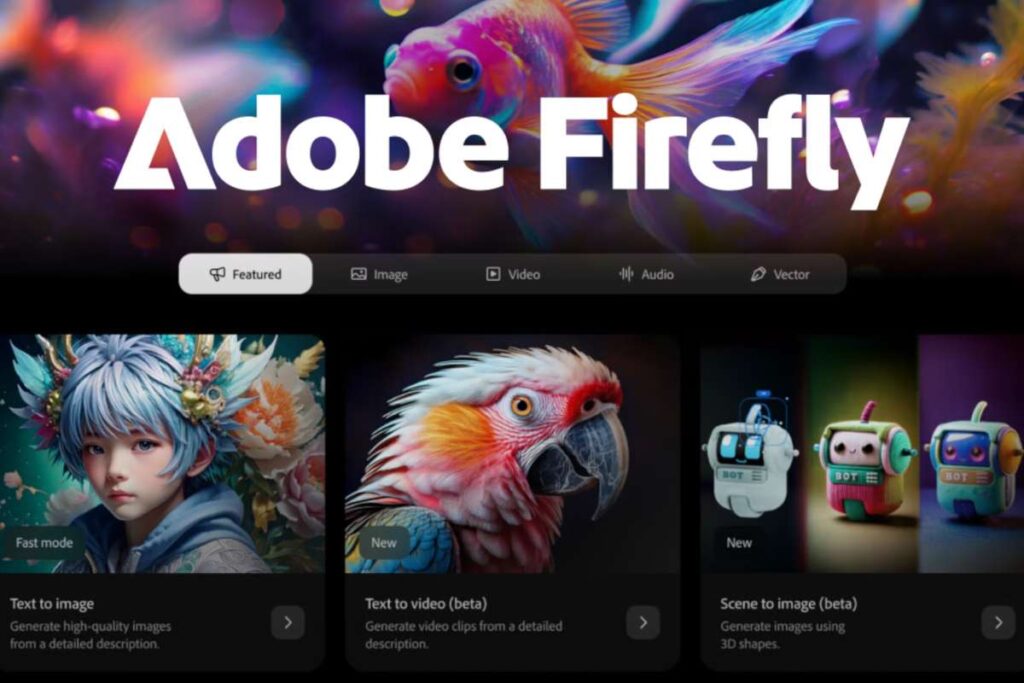

Adobe Firefly Responds with AI Innovation on Mobile Platforms

In response to the increasing market challenge, Adobe is ramping up its technological capabilities, particularly with its Firefly AI platform. On June 23, Adobe unveiled its AI-powered content creation suite, Adobe Firefly, for iOS and Android devices. The mobile rollout brings advanced features such as text-to-image and text-to-video generation to a broader user base, integrating seamlessly with several third-party AI models.

Adobe’s decision to expand Firefly’s reach to mobile users reflects its strategic aim to retain dominance in the creative software space by prioritizing accessibility and innovation. Early indicators suggest this approach is paying off—Adobe Firefly traffic reportedly rose by 30% quarter-over-quarter. This mobile expansion aligns with the company’s broader commitment to making AI-enhanced design tools more widely available and adaptable for modern creators on the go.

Adobe Firefly Analyst Sentiment and Investment Outlook

Despite the intensifying competition from Canva, analysts maintain a steady outlook on Adobe’s performance. Citizens JMP reaffirmed its “Market Perform” rating for Adobe, recognizing both the company’s robust product development and the emerging industry headwinds. Adobe continues to be regarded as a major player among top technology stocks, including within the informal FAANG+ group, due to its powerful software ecosystem encompassing staples like Photoshop, Illustrator, and Acrobat.

However, analysts also caution that while Adobe remains a solid investment, certain AI stocks may present greater upside with less downside risk. With global tech firms pivoting to AI Innovation and content automation, investor attention is shifting toward more agile and undervalued companies. A recent report even points to a lesser-known AI stock poised to benefit from Trump-era tariffs and domestic manufacturing trends, suggesting that diversified investment across emerging tech players may yield stronger short-term returns than legacy giants like Adobe.

Also Read :- Future Education Magazine